Cryptocurrency trading has been on the rise, and there are many people who wish to get in on the action. However, crypto traders can be wary of trading because of a risky investment option called leverage. In this article, we will break down the importance of using trade crypto with leverage.

Table Of Contents

How to Trade Crypto With Leverage

As the world of cryptocurrency continues to grow, so does the potential for fraudulent and unethical trading practices. In this article, we will discuss how to trade crypto with leverage, and whether or not it is a good idea to do so.

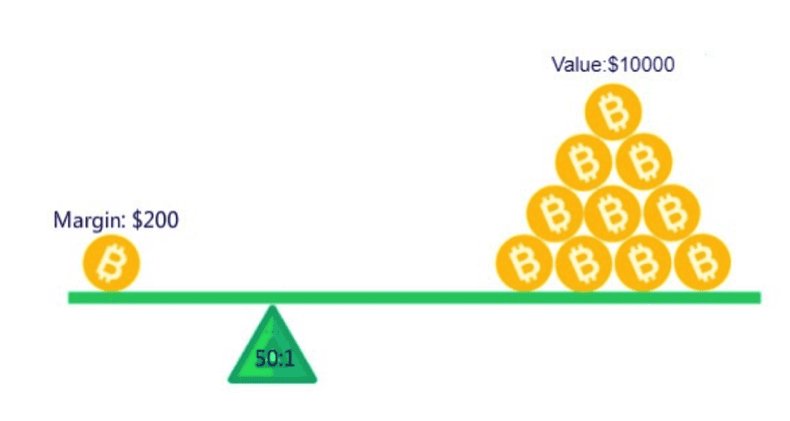

Before we get started, it is important to understand what leverage is. Simply put, leverage is a tool that allows traders to increase their profits by borrowing money from a broker or other financial institution. When used correctly, leverage can help you make more informed decisions when trading cryptocurrencies.

Now that we have a basic understanding of what leverage is and why it is important, let’s take a look at https://www.btcc.com/ some potential risks associated with using it. First and foremost, using too much leverage can lead to disastrous consequences. For example, if you borrow $10,000 worth of Bitcoin on margin and the price of Bitcoin drops by 50%, your losses would be $5,000 ($10,000 – $7,500 = $5,000). This is because your total position (Bitcoin plus the margin) would now be worth less than your original investment. If this happens multiple times in a row, you could find yourself in serious trouble.

How it is Beneficial?

It is beneficial to trade crypto with leverage. This is because when you trade with leverage, you are able to increase your profits by trading more assets than you have in your account. This allows you to make more money while you are still used to risking very little of your own money. Leverage has its limits, though. It only works if you have a margin account and it can work both ways. The risk of loss of the amount you are trading is dealt with by the leverage and thus, if there is no transaction in your favor, you will be taken down by this loss.

How to trade with leverage?

You can begin using leverage when you open a margin account. To do that, go to your nearest broker or find one through an online search engine or an advertisement. Find out their terms and conditions for opening a margin account and make sure that they match your requirements before giving them the green light for opening your account.

What are the Risks?

When trade crypto with leverage, you are essentially borrowing money from a broker to increase the potential return on your investment. This increases the risk of losing all of your money if the market moves against you. Additionally, if the cryptocurrency value falls, you may also lose all of your deposited funds.

Wrapping Up

There is no one-size-fits-all answer to this question, as the risks and rewards associated with trade crypto with leverage will vary depending on your individual circumstances. However, if you are comfortable with the risks involved and understand how cryptocurrency trading works, then using leverage could be a good way to increase your profits.