Swing trading is a type of trading that attempts to capture gains in a stock within one or two days. Swing traders use technical analysis to look for stocks with short-term price momentum. They then try to time their entries and exits around key technical indicators, such as moving averages, support and resistance levels, and momentum oscillators.

There are a variety of technical indicators that swing traders can use to identify potential trading opportunities. Some of the most popular indicators include moving averages, support and resistance levels, and momentum oscillators.

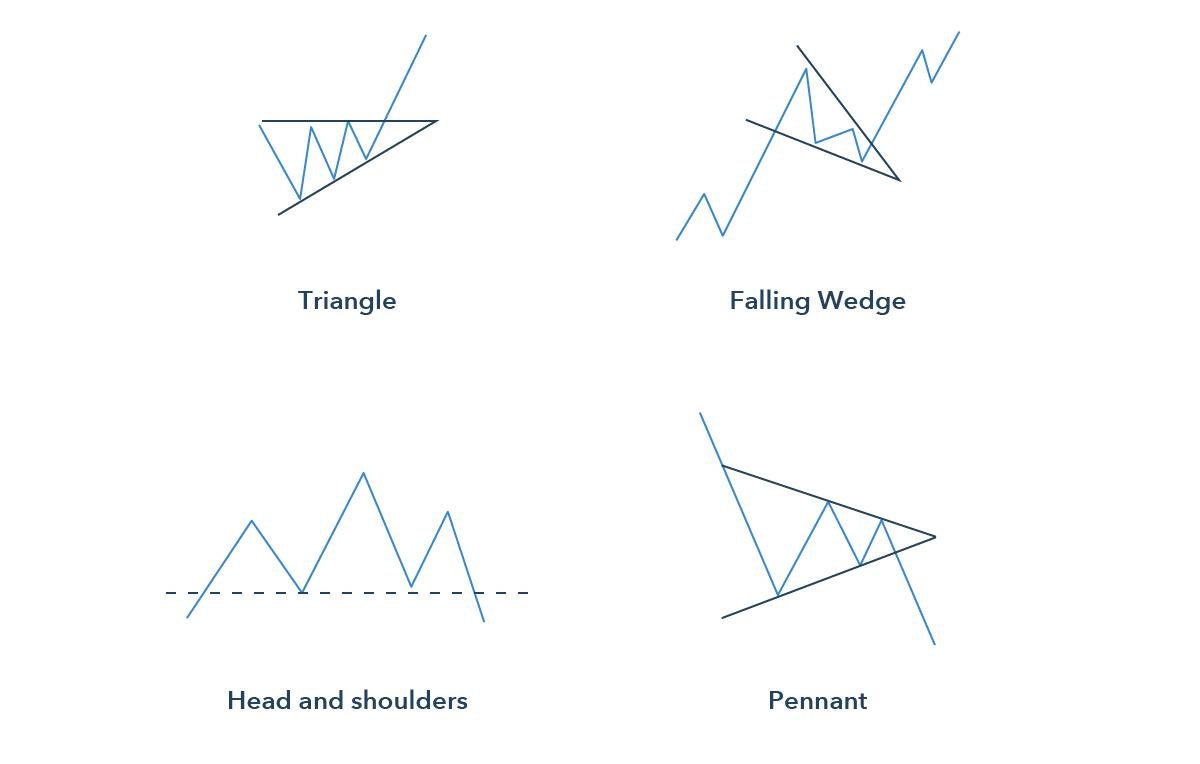

When combined with technical trading indicators, chart patterns can be a powerful tool:

Table Of Contents

- 1 Look for a candlestick chart pattern that indicates a potential reversal

- 2 Wait for confirmation of the pattern with another candlestick

- 3 Enter a trade when the confirmation candlestick closes

- 4 Place a stop-loss order below the low of the confirmation candlestick

- 5 Exit the trade when the price action reaches the bottom of the range

- 6 Final Thoughts

Look for a candlestick chart pattern that indicates a potential reversal

Chart patterns are a type of price pattern which can be used to predict the future direction of a share price. Candlestick chart patterns are the most popular chart pattern because they signal different trading opportunities.

Finding a candlestick pattern that indicates a potential reversal is not an easy task. There are many patterns to look for, and there is no single pattern that you can use as the be-all-end-all of patterns. You will need to analyse the trading chart closely to determine which one is most appropriate to continue trading with confidence.

A bullish reversal pattern, or “hammer,” on a chart tells traders they may be seeing the start of a bullish trend. Hammer candlesticks reflect indecision or uncertainty, followed by sudden bullish movement in price. They are characterised by short wicks at both ends and a long body in the middle. The shadow of the body should be at least two times greater than the height of the wick on either end.

There is a lot of debate about whether candlestick chart patterns indicate the start of reversal or not. One thing that traders need to remember is that there are no set rules for identifying reversal signals and each trader has their unique interpretation. But to yield profit trading bots like crypto genius are a traders best friend! You can click here for more information.

Wait for confirmation of the pattern with another candlestick

The first step was to recognize the pattern of candlesticks that is forming by looking at the chart. The second step is to wait for confirmation from the next candlestick in order to determine whether or not the pattern has confirmed or not.

For example, if we see a long red candlestick followed by a long black one, we can say that it confirms a bearish pattern in reverse.

The long red candlestick forms a bullish pattern and the long black one confirms it as such.

The pattern is confirmed when another candlestick forms and the price of the second candle is higher than the first one.

The rules for a valid confirmation pattern are as follows:

1) wait for confirmation of the pattern with another candlestick in second step;

2) the price of the second candle must be higher than that of first one.

Simply put, the candlestick pattern confirmation of the pattern with another candlestick is one of the most widely used methods for trading a “bullish” or “bearish” trend.

In the case of a bullish trend, if a small bearish candlestick emerges after a long sequence of bullish candlesticks, traders will wait for confirmation. This means they will wait until two consecutive bearish candles emerge following the small bearish candle.

If two consecutive bearish candles emerge, then traders will believe that there is no longer a bullish trend and they can sell their asset and enter into short positions.

Enter a trade when the confirmation candlestick closes

A trade can be opened in the same direction of the confirmation candlestick if it is a bullish or bearish candlestick, respectively. Conversely, a trade can be opened in the opposite direction of the confirmation candlestick if it is a bullish or bearish candlestick, respectively.

To be precise, trade enters a confirmation state when the candlestick closes.

The price needs to have met a condition before entering this state.

The price has to have closed at or above the opening price in order to enter a trade confirmation and vice versa.

If the confirmation candle is red then that means it was in an uptrend since the closing of the candle was higher than its opening price. Conversely, if it is green then it means it was in a downtrend since the closing of the candle is lower than its opening price.

Place a stop-loss order below the low of the confirmation candlestick

Stop-loss orders are the traders’ “safety net.” This order is designed to protect you from a sudden and significant loss in the event that your stock, option or other instrument takes an unexpected turn.

When you trade on an exchange, you must first place a stop-loss order below the low of the confirmation candlestick to limit your risk exposure in case of a sudden drop in price.

This order is defined as “selling a security or commodity on which you have incurred a loss at current market price, with the hope of cutting your losses before they run out of control.” It can also be called a sell-stop order.

To place a stop-loss order, first find an appropriate market price for your stop-loss point. Then select how many shares or contracts you want to sell and what price that should trigger this sell-stop order.

Exit the trade when the price action reaches the bottom of the range

Exit the swing trade when the price action reaches the bottom of the range is a well-known and successful trade strategy. The term “bottom of the range” means that the price has reached either one of its extremes. Practitioners define this as a point where there is no more potential for a trade to work in their favor, but there are only risks involved.

This is not to say that traders always have to exit when they reach the extreme; rather, it depends on when they opened their position and what type of strategy they are using. For example, if you buy at one extreme and sell at another, you can make money on both trades.

Final Thoughts

This article provides a guide on how to trade swing trading chart patterns with technical trading indicators. By following these instructions, you can improve your chances of success when trading swing trading chart patterns.