In Fox Nation’s new show “The Unauthorized History of Taxes,” host Bret Baier takes a deep dive into the 1960s and 1980s – two eras associated with cutting taxes and economic prosperity.

Both Presidents John F. Kennedy and Ronald Reagan believed in reducing taxes to jumpstart the economy. Reagan’s implementation of supply-side economics, which influences the supply of labor and goods through tax cuts, had a direct correlation to Kennedy’s economic policies.

Baier explained that at the beginning of the 60s, Democrats pushed to raise taxes to fund social programming while Republicans wanted the raise to pay down the federal debt. But Kennedy had a different plan that would “spark a revolution in tax policy.” He wanted to cut taxes and increase revenues.

TRACE THE COMPLEX HISTORY BETWEEN THE US GOVERNMENT AND AMERICANS IN BRET BAIER’S NEW SERIES

Laffer Associates founder and father of supply-side economics Art Laffer explained Kennedy’s tax cut, at most from 91% to 70%, launched the U.S. economy into surpluses as the stock market doubled by 1966.

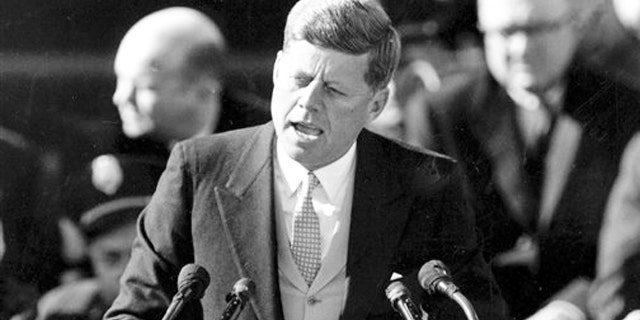

On January 20, 1961, President John F. Kennedy addressed the nation in his Inaugural Address and said what some consider his most famous statement, “And so my fellow Americans, ask not what your country can do for you; ask what you can do for your country. My fellow citizens of the world; ask not what America will do for you, but what we can do for the freedom of man.”

(AP, 1961)

“The Kennedy tax cuts gave us post-war prosperity,” Laffer Center’s Brian Domitrovic chimed in. “The economic growth from 1961 to 1969… was 5% per year. It had been 2.5% under Eisenhower. So that memory that this is the greatest era of mass affluence was occasioned by the Kennedy tax cuts.”

Join Fox Nation today to watch more episodes of “The Unauthorized History of Taxes” with Bret Baier.

Fox Nation programs are viewable on-demand and from your mobile device app, but only for Fox Nation subscribers. Go to Fox Nation to start a free trial and watch the extensive library from your favorite Fox News personalities.